2 Finance Stocks To Buy For Decent Returns In One Year, Says ICICI Direct

[ad_1]

Read More/Less

Why Bajaj Finance can be a good bet?

Bajaj Finance is a significant participant in the consumer finance area, but it has also dabbled in other lending segments such as housing, SME financing, and so on when chances arise.

ICICI Direct has set a price target of Rs 8950 on the stock of Bajaj Finance, as against the current market price of Rs 7780.

Why Bajaj Finance can be a good bet?

ICICI believes that it is currently adding 10 lakh wallets every month, with adequate capital of 28.5 percent, a concentration on technology, and a turnaround in the client acquisition trend all pointing to future development. From H2FY22 onwards, asset quality is expected to stabilise, with a faster recovery and gradual unlocking.

The share price of Bajaj Finance has increased by 7.2 times in the last five years, from roughly 1,100 in September 2016 to around 7800 in September 2021.

Target Price and Valuation of Bajaj Finance

“Bajaj Finance’s share price has grown by ~7.2x over the past five years. Factoring in management agility towards product development and process modification to suit the situation. We maintain our BUY rating on the stock.

Target Price and Valuation: We remain positive and factoring in high NIMs with risk adjusted growth we value the stock at ~10x P/ABV on FY23E and revise our target price to Rs 8950 from Rs 6900 earlier. Premium valuations stay,” the brokerage has said.

Key triggers for future price-performance:

- To boost values, make the switch from being a pure lender to fin-tech.

- RoE is expected to return to 15% and RoA to around 3%.

- A leaner operational approach and solid growth projections.

Alternative Stock Idea: In addition to BAF, we prefer HDFC Ltd in our BFSI coverage.

HDFC Ltd is India’s largest housing financing firm, with a loan portfolio of $ 4.98 lakh crore. Through its subsidiaries, the corporation also has a presence in other financial services categories.

Why Bajaj Finserv can be a good bet?

Bajaj Finserv is a financial conglomerate having interests in finance (Bajaj Finance), life insurance (Bajaj Life Insurance), and general insurance (Bajaj General Insurance).

ICICI Direct has set a price target of Rs 20,200 on the stock of Bajaj Finserv, as against the current market price of Rs 17,510.

Why Bajaj Finserv Bajaj Finserv can be a good bet?

- Long-term positives include traction in insurance and digitalization in financing.

- Bajaj Finance launched its wallet business in July 2021, and by FY23, it hopes to have onboarded 2.5 crore clients.

- Premium growth of 20% in general insurance for April-July21 helps market share gain of 30 basis points to 7.9%.

- Premiums for life insurance increased by 40% year over year in April-July21, outpacing the industry.

- A foray into the mutual fund business would add value to the franchisee’s overall operation.

The share price of Bajaj Finserv has increased by nearly 6 times in the last five years, from 2,900 in September 2016 to around 18,000 per share now.

Target Price and Valuation of Bajaj Finserv

“Bajaj Finserv’s share price has grown by ~6x over the past five years. We upgrade our rating on the stock from HOLD to BUY. Target Price and Valuation: We value Finserv at ~45x FY23 EPS to arrive at a revised Target Price of Rs 20200 per share from Rs 13500 earlier.

Key triggers for future price-performance:

- For FY22E and FY23E, expect AUM growth of 20% and 22%, respectively, and PAT growth of 30% and 45 percent.

- From H2FY22 forward, asset quality will stabilise.

- In the life and general insurance sector, robust premium growth and a carefully chosen product mix will promote business growth and earnings.

Disclaimer

The above stocks are picked from the brokerage report of ICICI Direct. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution. Greynium Information Technologies, the author, and the brokerage house are not liable for any losses caused as a result of decisions based on the article.

[ad_2]

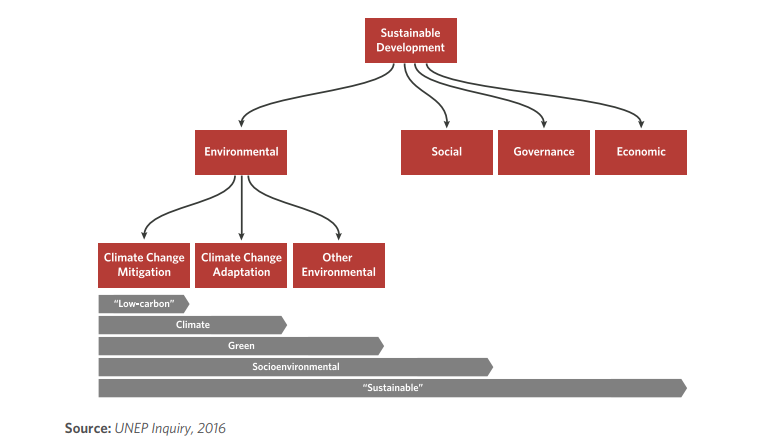

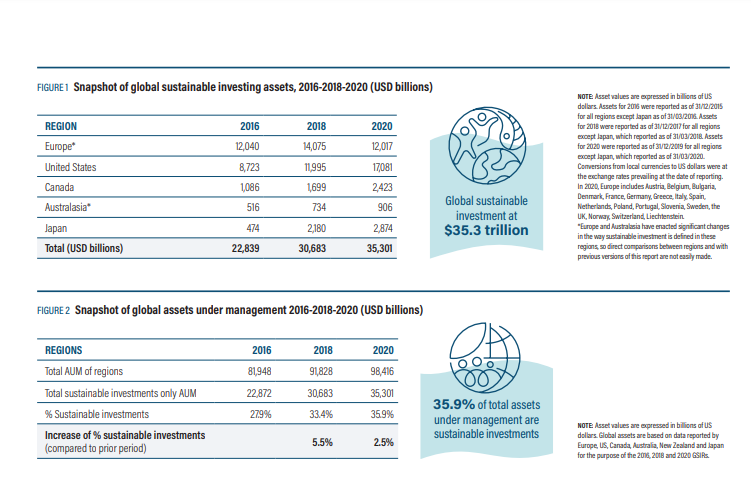

Source: Global Sustainable Investment Alliance

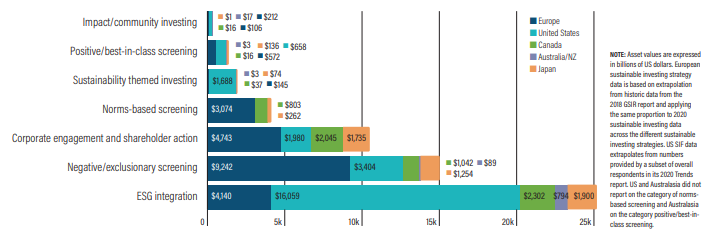

Source: Global Sustainable Investment Alliance Sustainable investing assets by strategy & region 2020 (Source: Global Sustainable Investment Alliance)

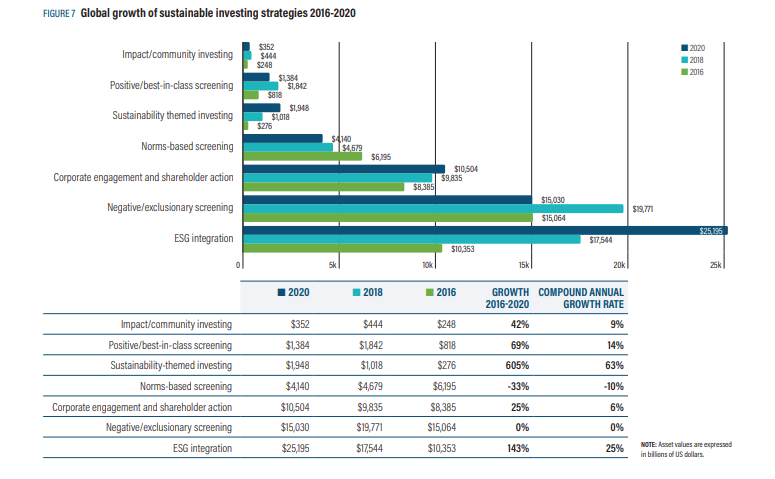

Sustainable investing assets by strategy & region 2020 (Source: Global Sustainable Investment Alliance) Global growth of sustainable investing strategies 2016-2020 (Source: Global Sustainable Investment Alliance)

Global growth of sustainable investing strategies 2016-2020 (Source: Global Sustainable Investment Alliance)